|

Our office has moved! We are now located at 415 South Duff, Ste B, Ames IA 50010. Our phone number (515-232-9271), email ([email protected]), and website (www.alliancegeneralinsurance.com) has all stayed the same.

0 Comments

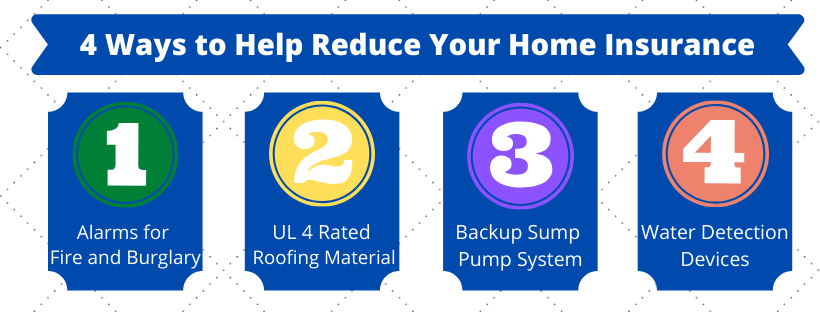

Just discussed this with a client building a new home. We also have many clients revamping their current home. Here are some things that can reduce your home insurance. There is a discount for having alarms for fire and burglary. There are a lot of technologies out there. Burglar and fire alarms that are monitored by a 3rd party give the bigger discount. But even the alarms that alert your phone with video/data sharing provide a discount. 3 other items that I would consider. With some carriers these will discount your home policy. More importantly these could prevent or minimize a claim. Avoiding a deductible, the mess, and the hassle has big value. 1. Roofing material that has a UL 4 rating. This can avoid most hail events and will also last much longer. The newer the roof the better the discount. The better and newer the roof is an even better discount. 2. Backup sump pump system – municipal water or battery backup. If done during construction it is minimal cost. I would do the municipal water backup. No electricity=no sump pump. When do you need a sump pump? During a storm. When does power go out? During a storm. This is why the backups are huge. Plus some are a 2nd pump so even if you have power it may be the difference maker. 3. There are some new water detection devices out there that will alert you or turn off the water when a water leak is detected. Washing machine, dishwasher, & water line to fridge are your 3 leakers and cause massive damage. If you have done any of the above please call us at 515-232-9271. Or if you are interested in the municipal water backup we do work with some great local plumbers. ~Jeff Eastvold As kids head back to school in many districts across Iowa today, drivers need to pay extra attention to the rules of the roads and be on the look-out for school buses, pedestrians, and students riding their bikes to and from school. 1. Make sure to slow down in school zones - know the times of day that the reduced speed limits are in effect. If you travel through a school zone on your commute, plan to give yourself a few extra minutes due to increased traffic and a slower speed limit. Speeding tickets are double what you would normally pay in some school zones. 2. Pedestrians have the right-of-way at all crosswalks and intersections - be on the look-out for kids crossing at unmarked crosswalks as well. Not all schools have crossing guards directing students/parents when to cross the street. 3. Make sure to slow down or stop for school buses. If you encounter a school bus with its yellow lights flashing, you must slow down and go no faster than 20 mph. If the red lights are flashing or the stop arm is out, you must stop at least 15 feet from the school bus. You must remain stopped while the lights are flashing and the stop arm is out. After a school bus has stopped to let students off, watch for children on the side of the road. When do you have to stop for a school bus? SCENARIO 1: YOU ARE TRAVELING ON A TWO- OR THREE-LANE ROAD When you are approaching the bus from the rear: When you see flashing red or yellow warning lights, you are not permitted to pass the school bus and you should be prepared to stop. Stop behind the school bus when the school bus stops and the stop arm is extended. Stop no closer than 15 feet from the rear of the bus, and remain stopped until the stop arm is retracted and school bus starts moving again. Proceed with caution. When you are meeting the bus from the front: When you see yellow warning lights flashing you must slow your vehicle to no more than 20 mph and be prepared to stop. Stop in front of the school bus when the school bus stops and its stop arm is extended. Remain stopped until the stop arm is retracted. Proceed with caution. SCENARIO 2: YOU ARE TRAVELING ON A ROAD WITH TWO OR MORE LANES IN EACH DIRECTION

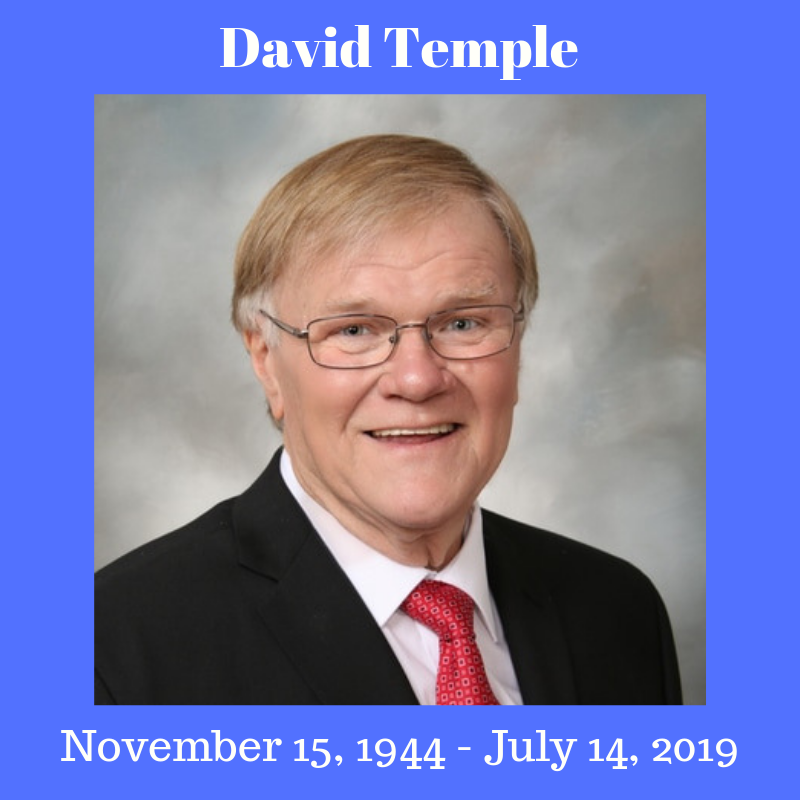

When you are approaching the bus from the rear: When approaching from the rear, the rules are the same as for a two- or three- lane road. When you see flashing red or yellow warning lights, you are not permitted to pass the school bus and should be prepared to stop. Stop behind the school bus when the school bus stops and its stop arm is extended. Stop no closer than 15 feet from the rear of the bus, and remain stopped until the stop arm is retracted and school bus starts moving again. Proceed with caution. When you are meeting the bus from the front: When meeting the bus in one of the opposite two lanes (or more), you do not need to stop, even if the bus has stopped with lights flashing and stop arm out. The bus is not permitted to load or unload children who must cross this type of roadway, unless there are official traffic control devices or law enforcement present. This is the only time you may pass a school bus that is stopped and has its stop arm extended. As we are sure you can understand, the passing of Dave Temple has left us in grief for our loss. However, Dave was one to make sure the ones he loved and his clients were always taken of. David never wanted to retire because he loved what he did. He considered so many of his clients his friends. We know many of his clients here have a history with David going back many years. When you love what you do and who you work with then it wasn’t work. We are so glad that he was able to do that until the end.

Alliance General and building relationships with clients has always been important to David. Alliance General was very important to Dave, and he has always aimed to provide a high-level of service to his clients since he opened the agency in 1982. We want to make it clear that this will not change. Over 10 years ago, Alliance General merged with a sister agency, Absolute Insurance Agency, in Clive, IA. Absolute Insurance Agency was started by Jeff Eastvold over 12 years ago. Jeff had worked with Dave and Alliance General back in the early 1990’s and has over 25 years experience in the insurance industry. David and Jeff have worked together for many years, and David was Jeff’s mentor, friend, and like a father in many ways to Jeff. About 2 years ago, Jeff purchased Alliance General from David and Cheri, and has worked hard to provide the same level of service to our customers. We want to reassure customers that Alliance General will stay open and we will continue to provide the same service that you are used to. Our office will remain open in the same location (319 Lincoln way, Ste 1, Ames, IA 50010) and our phone number will stay the same (515-232-9271). If you have stopped into the office over the past few years, or called into the office, you have most likely met and/or spoken with some of the agents that represent Alliance General and Absolute Insurance. Alliance General will be closed at 3:30 on Thursday, July 18th, for visitation, and closed Friday, July 19th, for the funeral. We will have staff answering phone calls. The office will re-open on Monday with normal hours. Additional information about David Temple's visitation and funeral can be found here: https://www.grandonfuneralandcremationcare.com/obituary/320162/David-Temple/ If you have any questions, please reach out to Jeff Eastvold ([email protected]), Dan Bell ([email protected]), or Storm Eastvold ([email protected]). Have you ever looked at your homeowners, condo, or renters policy and saw that your property, belongings, and/or roof is listed as being insured for Replacement Cost Value (RCV) or Actual Cost Value (ACV)? Have you ever wondered what that means?

Replacement Cost (RCV) is the value to replace an item at today's cost. Actual Cash Value (ACV) is the value for a similar item at today's cost minus depreciation (replacement cost minus depreciation). What does this mean? Let's use an example most people have in their house - a couch. Four years ago when you moved into your house, you purchased a new sectional for $2500. Last month, your sectional couch was damaged in a covered claim.

RCV and ACV also affects how your roof is insured too. Some companies only offer RCV coverage for roofs if they were installed within the last 15 years, otherwise the roof is covered for ACV. Here are some important things you can do:

Workers' compensation coverage provides medical expenses, lost wages, and physical rehabilitation costs to employees who are injured or become ill "in the course and scope" of their job. Additionally, this coverage protects an employer from being sued by an injured worker in most cases.

Alliance General Insurance can help your business find complete solutions to your unique workers compensation insurance needs. We'll find solutions that create safer and more productive workplaces, more confident and secure workers and overall savings you'll see on the bottom line. Coverage for office workers using their own vehicles on company business is often needed, as well. If you have employees, it is critical that you consider this workers compensation coverage. Some Workers Compensation coverage can include:

This is the time to prepare your vehicle for the upcoming winter. Here are some tips:

We often talk to our clients about adding jewelry and other items as Scheduled Personal Property, or SPP, to your Homeowners, Renters, Dwelling, or Condo Insurance Policy. Have you ever wondered how SPP is different than the regular contents coverage included on your policy? While your typical homeowners policy includes limited personal property coverage for the contents of the home, sometimes there are limits placed on certain categories of valuable covered items. For example, a homeowner insurance policy might have a $1500 sub-limit on jewelry. If you had a loss for a necklace valued at $400, you would probably be fine getting it covered under your homeowners insurance policy (assuming it was lost under a covered peril), but if you had a necklace worth $5700, you would most likely only be covered up to that $1500 policy sub-limit. Many homeowners choose to seek additional coverage through a scheduled personal property endorsement to their policy. Scheduled Personal Property also provides broader coverage for the scheduled items. For example, if your wedding ring drops down the drain while you are washing dishes it may not be covered unless it is included as a Scheduled Personal Property item on your policy. Also, if a loss were to happen to a SPP item, the policy deductible doesn't apply. What types of items can be added as SPP?

Each item that is added as Scheduled Personal Property to a policy is listed individually and needs to be appraised before they are added. If it is a recent purchase, the receipt might work in place of an appraisal. Please contact your Alliance General Insurance agent at 515-232-9271. Do you have a student heading off to college this year, and are wondering whether their personal belongings are insured under your homeowners insurance policy? The quick answer - it depends.

If your student is living in a dorm or on-campus housing, their personal property belongings are most likely covered under their parents' homeowners insurance policy. Please check with your agent to see if your policy covers a student living on-campus. Another thing to consider, is that many homeowners insurance policies limit the amount of insurance for off-premises belongings to 10 percent of the policies personal property coverage. This means that if a policy has coverage for $60,000 worth of insurance for belongings, only $6,000 coverage would be applicable to the belongings in a dorm room or on-campus residence. With most homeowners insurance policies, there is a limit for certain items such as computer and electronic equipment and jewelry. If the student has items that are above the standard limit on an insurance policy, these items should be scheduled separately as a Scheduled Personal Property (SPP) endorsement to their homeowners policy. If your student is living off-campus, their belongings are most likely not covered under their parents' policy and should obtain their own renter's insurance policy to cover their belongings. For students going off to college, the Insurance Information Institute recommends the following things:

If you have a student away at college and want to check if their belongings are covered, please contact your Alliance General Insurance agent at (515) 232-9271. Everyone likes to save money where it makes sense. One place you may be able to save money is by making sure that you are getting the discount that your insurance company offers. Some of the most common insurance discounts are listed below:

|

Archives

June 2020

Categories

All

|

RSS Feed

RSS Feed