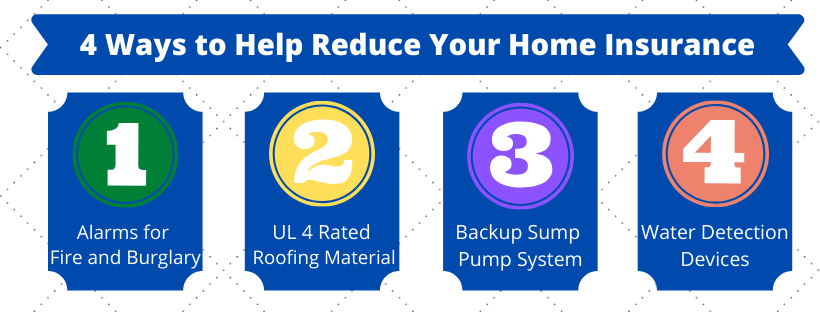

Just discussed this with a client building a new home. We also have many clients revamping their current home. Here are some things that can reduce your home insurance. There is a discount for having alarms for fire and burglary. There are a lot of technologies out there. Burglar and fire alarms that are monitored by a 3rd party give the bigger discount. But even the alarms that alert your phone with video/data sharing provide a discount. 3 other items that I would consider. With some carriers these will discount your home policy. More importantly these could prevent or minimize a claim. Avoiding a deductible, the mess, and the hassle has big value. 1. Roofing material that has a UL 4 rating. This can avoid most hail events and will also last much longer. The newer the roof the better the discount. The better and newer the roof is an even better discount. 2. Backup sump pump system – municipal water or battery backup. If done during construction it is minimal cost. I would do the municipal water backup. No electricity=no sump pump. When do you need a sump pump? During a storm. When does power go out? During a storm. This is why the backups are huge. Plus some are a 2nd pump so even if you have power it may be the difference maker. 3. There are some new water detection devices out there that will alert you or turn off the water when a water leak is detected. Washing machine, dishwasher, & water line to fridge are your 3 leakers and cause massive damage. If you have done any of the above please call us at 515-232-9271. Or if you are interested in the municipal water backup we do work with some great local plumbers. ~Jeff Eastvold

0 Comments

Have you ever looked at your homeowners, condo, or renters policy and saw that your property, belongings, and/or roof is listed as being insured for Replacement Cost Value (RCV) or Actual Cost Value (ACV)? Have you ever wondered what that means?

Replacement Cost (RCV) is the value to replace an item at today's cost. Actual Cash Value (ACV) is the value for a similar item at today's cost minus depreciation (replacement cost minus depreciation). What does this mean? Let's use an example most people have in their house - a couch. Four years ago when you moved into your house, you purchased a new sectional for $2500. Last month, your sectional couch was damaged in a covered claim.

RCV and ACV also affects how your roof is insured too. Some companies only offer RCV coverage for roofs if they were installed within the last 15 years, otherwise the roof is covered for ACV. Here are some important things you can do:

We often talk to our clients about adding jewelry and other items as Scheduled Personal Property, or SPP, to your Homeowners, Renters, Dwelling, or Condo Insurance Policy. Have you ever wondered how SPP is different than the regular contents coverage included on your policy? While your typical homeowners policy includes limited personal property coverage for the contents of the home, sometimes there are limits placed on certain categories of valuable covered items. For example, a homeowner insurance policy might have a $1500 sub-limit on jewelry. If you had a loss for a necklace valued at $400, you would probably be fine getting it covered under your homeowners insurance policy (assuming it was lost under a covered peril), but if you had a necklace worth $5700, you would most likely only be covered up to that $1500 policy sub-limit. Many homeowners choose to seek additional coverage through a scheduled personal property endorsement to their policy. Scheduled Personal Property also provides broader coverage for the scheduled items. For example, if your wedding ring drops down the drain while you are washing dishes it may not be covered unless it is included as a Scheduled Personal Property item on your policy. Also, if a loss were to happen to a SPP item, the policy deductible doesn't apply. What types of items can be added as SPP?

Each item that is added as Scheduled Personal Property to a policy is listed individually and needs to be appraised before they are added. If it is a recent purchase, the receipt might work in place of an appraisal. Please contact your Alliance General Insurance agent at 515-232-9271. |

Archives

June 2020

Categories

All

|

RSS Feed

RSS Feed